CCJ In Heng Insights

Explore the latest trends and insights across diverse topics.

Insurance Showdown: Finding the Best Deals Without Losing Your Mind

Unlock the secrets to scoring unbeatable insurance deals! Discover how to navigate the chaos with ease and save big today!

Top 5 Tips for Comparing Insurance Providers Like a Pro

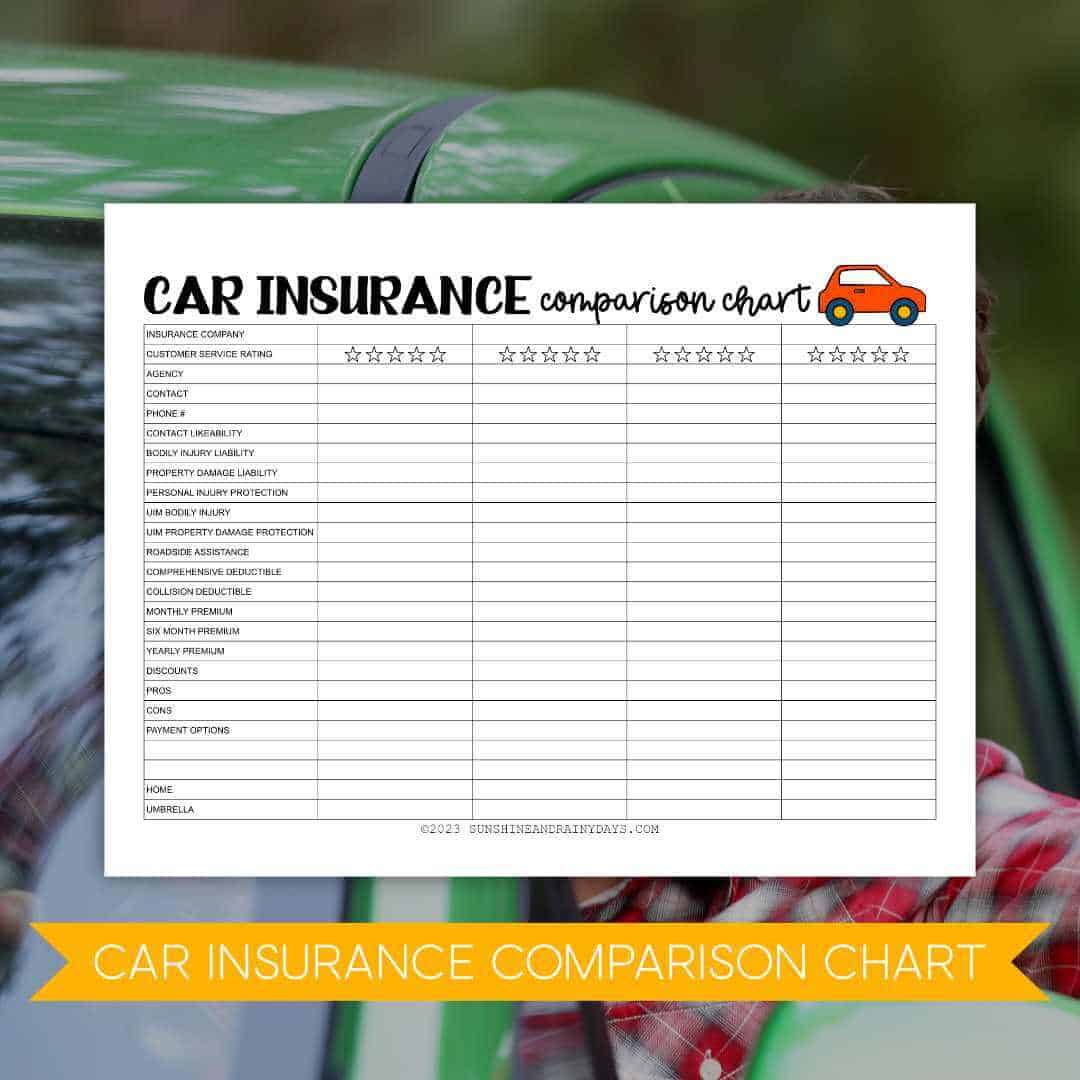

When it comes to comparing insurance providers, having a systematic approach can make all the difference. Start by identifying your specific needs and the types of coverage you require. Insurance providers often offer different benefits and coverage options, so it’s crucial to make a list of your priorities. Once you know what you need, gather quotes from multiple providers to ensure you are making an informed comparison. Reviewing these quotes side by side will help you see not only the pricing differences but also how each policy aligns with your needs.

Next, consider the reputation and financial stability of each insurance provider. Look for customer reviews and ratings, as they can give you insight into how well each company manages claims and customer service. Additionally, check if the provider has the resources to support your claims effectively. You might also want to inquire about discounts and additional services they offer. By focusing on both quality and value, you can make a well-rounded decision when comparing insurance providers.

Understanding Insurance Terminology: A Beginner's Guide

Understanding insurance terminology is crucial for anyone looking to navigate the often complex world of insurance. This beginner's guide will help demystify key terms that can empower you to make informed decisions. Some fundamental terms include:

- Premium: The amount you pay for your insurance policy.

- Deductible: The amount you must pay out-of-pocket before your insurance kicks in.

- Coverage: The protection provided by the insurance policy.

As you learn these important terms, remember that understanding the language of insurance can lead to better choices and financial protection. Additionally, familiarize yourself with exclusions—situations or items not covered by your policy—and beneficiary, the person designated to receive benefits from your policy. By grasping these key concepts, you'll pave the way for effective communication with insurance providers and a better understanding of your coverage needs.

How to Spot Hidden Fees in Your Insurance Policies

When reviewing your insurance policies, it’s crucial to know how to spot hidden fees that can impact your overall costs. Start by thoroughly reading the policy documents. Look for sections labeled as premium adjustments, administrative fees, or service charges. These are often buried in fine print or described in complex terms that can easily be overlooked. Make a checklist of potential fees and cross-reference them against what you’re being charged. If anything seems out of the ordinary, don’t hesitate to ask your insurance agent for clarification.

Another effective strategy to uncover hidden fees is to compare multiple insurance policies from different providers. Use an itemized fee breakdown for comparison. Highlight any discrepancies in fees, such as renewal fees, cancellation charges, or excess fees for claims processing. Additionally, reading customer reviews can provide insights into whether other policyholders have encountered unexpected charges, helping you make a more informed decision. Remember, being proactive in your policy review can save you significant amounts in the long run.