CCJ In Heng Insights

Explore the latest trends and insights across diverse topics.

Term Life Insurance: A Safety Net or Just Another Expense?

Is term life insurance a smart safety net or just another monthly bill draining your wallet? Discover the truth in our latest blog!

Is Term Life Insurance Worth the Investment?

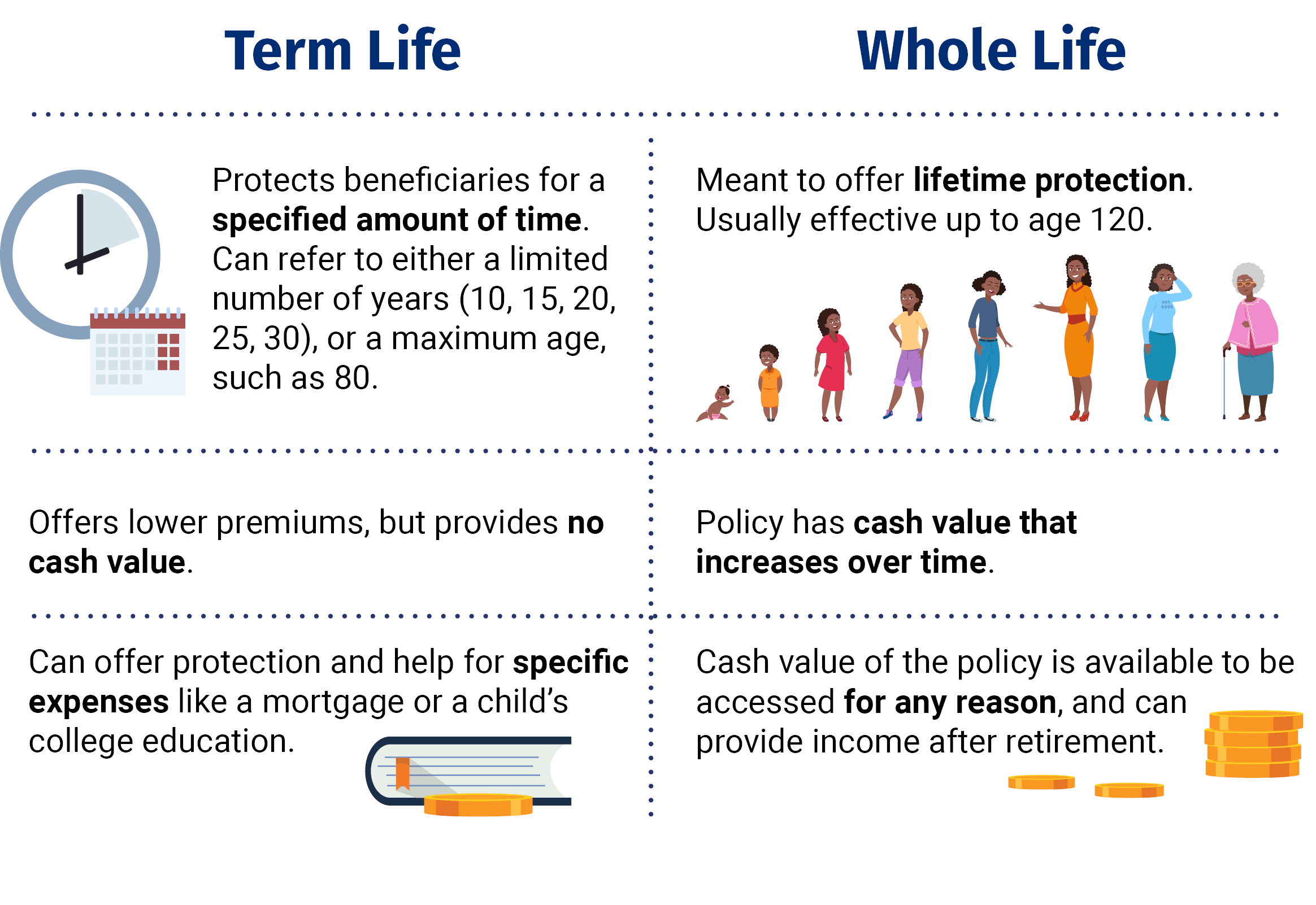

When considering the question, Is term life insurance worth the investment?, it's important to understand the fundamental benefits it offers. Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years, making it an affordable option for many individuals and families. This type of insurance is designed to replace lost income in the event of an untimely passing, ensuring your loved ones are financially secure during challenging times. Its lower premiums compared to whole life insurance make it a practical choice for those who need coverage without breaking the bank.

However, the worth of term life insurance goes beyond just its affordability. For many, it provides peace of mind, knowing that their family's financial obligations—such as mortgage payments, children's education, and everyday living expenses—are taken care of in their absence. Additionally, it allows individuals to allocate the savings from lower premium costs towards other investments, such as retirement accounts or emergency funds. Ultimately, whether term life insurance is worth the investment depends on your personal circumstances, financial goals, and the level of protection you want to provide for your loved ones.

Understanding the Benefits and Drawbacks of Term Life Insurance

Term life insurance provides a safety net for families during critical financial periods. One of the primary benefits of this type of insurance is its affordability. Premiums are generally lower compared to permanent life insurance, making it accessible for young families or individuals with limited budgets. Additionally, term life insurance can offer coverage for specific periods, such as 10, 20, or 30 years, allowing policyholders to align their coverage with significant life events such as raising children or paying off a mortgage. In this way, term life insurance serves as a crucial tool for financial planning, ensuring that loved ones are protected during the most impactful stages of life.

However, there are also notable drawbacks to consider. The most significant drawback of term life insurance is that it provides coverage only for a specified period. Once the term expires, the policyholder may have to purchase a new policy at potentially higher rates due to age or health changes. Additionally, term life insurance does not accumulate cash value like permanent life insurance policies, meaning that your investment does not grow over time. This lack of cash value may deter some individuals who are looking for long-term financial security. Ultimately, it's essential to weigh these benefits and drawbacks carefully to determine if term life insurance aligns with your financial goals.

How Does Term Life Insurance Provide Financial Security for Your Family?

Term life insurance serves as a crucial financial safety net for families, offering a predetermined sum of money to beneficiaries in the event of the policyholder's untimely death. This benefit ensures that loved ones are protected from financial hardships, such as lost income, outstanding debts, and ongoing living expenses. By securing a term life policy, families can maintain their standard of living and cover essential costs during a challenging time, providing peace of mind and stability.

In addition, term life insurance can be an affordable option for many families, making it easier to incorporate into a budget. Premiums are generally lower than those of permanent life insurance policies, allowing families to invest in coverage that aligns with their financial goals. Furthermore, the payout from a term life insurance policy can be utilized for various purposes, including funding education for children, paying off a mortgage, or ensuring that funeral expenses are taken care of, thereby reducing the financial burden during a difficult period.