CCJ In Heng Insights

Explore the latest trends and insights across diverse topics.

Force Buy Frenzy: When Saving Just Isn't an Option

Unlock the secrets behind Force Buy Frenzy—when splurging is the only choice! Discover why saving takes a backseat in this thrilling read.

Understanding the Psychology Behind Force Buy Frenzy

The psychology behind force buy frenzy is deeply rooted in human behavior and decision-making processes. It often exploits cognitive biases, such as the scarcity principle, where individuals perceive an item as more valuable when it is limited in availability. This phenomenon creates a sense of urgency that prompts consumers to act quickly, often bypassing rational decision-making. The fear of missing out (FOMO) further intensifies this effect, leading to impulsive purchases driven by emotions rather than necessity.

Additionally, social proof plays a crucial role in enhancing the force buy frenzy. When potential buyers see that others are purchasing a product or that it is highly rated, they are more likely to follow suit, believing that this collective behavior signifies a good decision. This can create a domino effect, where the actions of a few influence the masses, amplifying the sense of urgency and driving sales. As this cycle continues, businesses leverage these psychological triggers through marketing strategies that emphasize limited-time offers and exclusive deals, effectively harnessing human psychology to boost conversions.

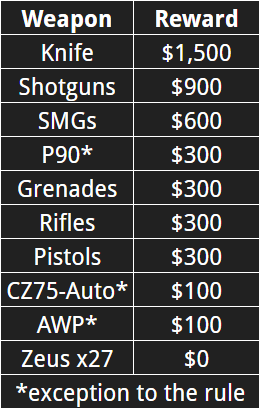

Counter-Strike is a popular series of multiplayer first-person shooter games that emphasizes team-based gameplay and tactical strategy. Players can often encounter issues such as lag and packet loss, which can adversely affect their gaming experience. To learn how to fix packet loss cs2, players can refer to various guides and resources available online.

Is It Worth It? Evaluating the Cost of Last-Minute Purchases

In today's fast-paced world, last-minute purchases have become increasingly common, especially with the convenience of online shopping at our fingertips. However, individuals should carefully evaluate whether the benefits of these impulsive buys outweigh the costs. Often, the allure of a good deal can overshadow the reality that these purchases frequently incur higher prices than planned purchases. Buying items in haste can also lead to regrettable decisions, such as acquiring unnecessary items or missing out on better deals available when shopping in advance.

To truly understand the impact of last-minute purchases, consider the following factors:

- Financial impact: Costs can spiral when buying on impulse, leading to budget overruns.

- Emotional impact: The regret of a hasty decision can linger, resulting in buyer's remorse.

- Opportunity cost: Money spent on an impulsive item could have been better allocated elsewhere.

How to Recognize and Avoid Impulsive Buying Triggers

Recognizing and avoiding impulsive buying triggers is essential for anyone looking to manage their finances effectively. One of the first steps is to identify your personal triggers. These may include emotional states like stress, boredom, or anxiety. To help you with this, keep a journal where you note down your purchases along with your feelings at the time. Over time, you'll likely notice patterns that illuminate specific situations or emotions that lead to impulsive buys.

Once you’ve recognized your impulsive buying triggers, you can take proactive measures to avoid them. For example, if you find that online shopping during late-night hours is a trigger for you, consider setting a strict shopping time limit. Additionally, creating a shopping list before you head out or log on can help you stay focused on necessary purchases. Remember, the key is to create a plan and stick to it, enabling you to make more informed and intentional spending decisions.