CCJ In Heng Insights

Explore the latest trends and insights across diverse topics.

Insurance for the Unexpected: Why Disability Coverage is a No-Brainer

Discover why disability coverage is a must-have! Protect your future today and prepare for life's surprises. Don't leave your income to chance!

Understanding Disability Insurance: Protecting Your Income in Unforeseen Circumstances

Understanding disability insurance is crucial for safeguarding your income against unexpected events that could impact your ability to work. This type of insurance provides financial support if you become unable to perform your job due to a medical condition or injury. Most policies offer a monthly benefit that replaces a portion of your lost income, helping you manage essential expenses such as housing, groceries, and healthcare. By investing in disability insurance, you're taking a proactive step to secure your financial future and maintain stability during challenging times.

There are a few critical factors to consider when choosing a disability insurance policy:

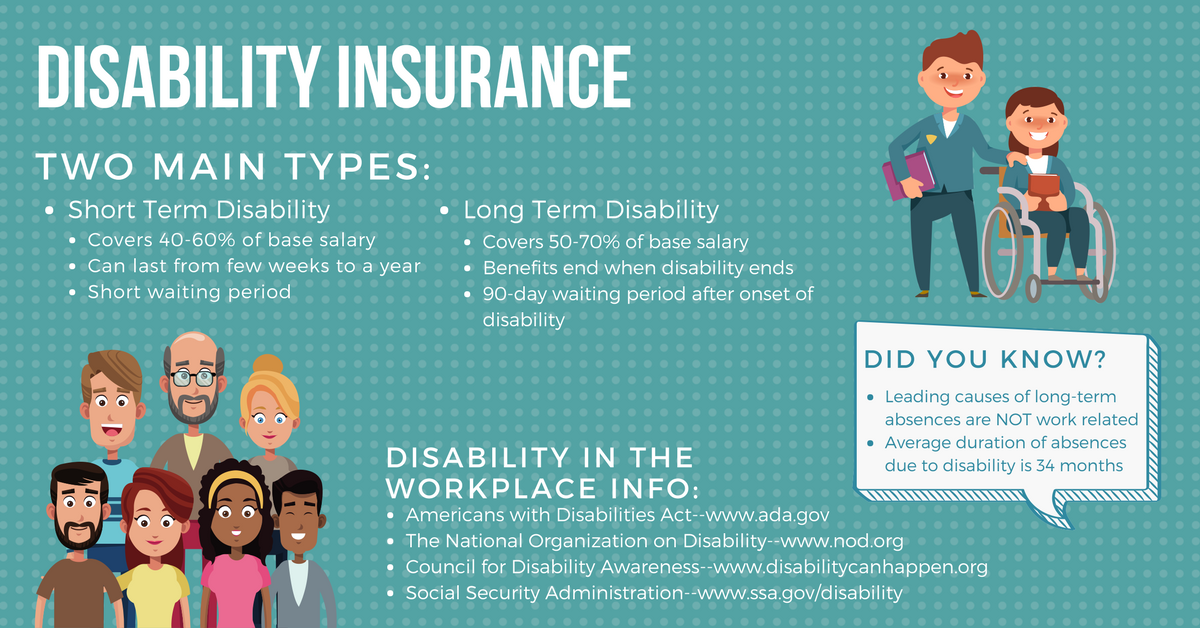

- Types of Coverage: Understand the difference between short-term and long-term disability insurance.

- Benefit Period: Determine how long you will receive benefits after a claim.

- Waiting Period: Assess how long you will have to wait before benefits kick in.

With the right policy, you can ensure that, in the event of unforeseen circumstances, you are not left without the means to support yourself and your family.

Top 5 Reasons Why Disability Coverage is Essential for Everyone

Disability coverage is often perceived as a luxury, but it is, in fact, a necessity for everyone. One key reason is that accidents and illnesses can strike at any time. According to statistics, a significant percentage of working adults will experience a disability to some degree during their careers. This risk emphasizes the importance of having a safety net that ensures financial stability when unexpected health challenges arise. Without proper coverage, individuals may find themselves resorting to savings or, worse, accumulating debt to cover everyday expenses.

Furthermore, disability coverage provides peace of mind not only to the individual but also to their families. Knowing that there is a financial protection plan in place alleviates stress during difficult times, allowing individuals to focus on recovery rather than worrying about their bills. In summary, disability coverage is essential because it safeguards against unforeseen life events, supports financial security, and brings much-needed reassurance to both policyholders and their loved ones.

Is Disability Insurance Worth It? Debunking Common Myths and Misconceptions

When considering whether disability insurance is worth it, many individuals are often swayed by common myths and misconceptions that cloud their judgment. One prevalent myth is that disability insurance is only necessary for those in high-risk professions. In reality, anyone can suffer from an illness or injury that prevents them from working, regardless of their job. A study shows that approximately 1 in 4 workers will experience a disability before retirement age, emphasizing that investing in disability insurance is a prudent decision for almost anyone looking to secure their financial future.

Another common misunderstanding is the belief that disability insurance is too expensive and not worth the cost. In fact, the premiums for disability insurance can often be more reasonable than expected, particularly when considering the potential financial impact of being unable to work. For instance, if an unexpected event leaves you unable to earn an income, having this coverage can provide vital financial support. It’s essential to assess your unique situation and calculate the potential risks of living without disability insurance, as the peace of mind it provides often far outweighs the cost.